Coagulation Analyzer Market Size, Share & Trends Analysis Report By Product (Analyzers, Consumables), By Technology (Mechanical, Electrochemical, Optical), By Test (APTT), By End Use, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-294-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Coagulation Analyzer Market Size & Trends

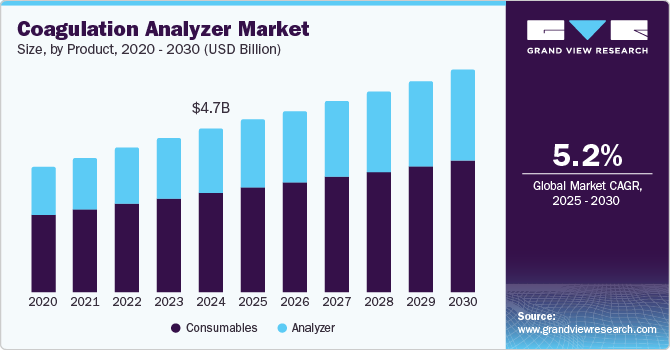

The global coagulation analyzer market size was valued at USD 4.72 billion in 2024 and is expected to grow at a CAGR of 5.2% from 2025 to 2030. This growth is attributed to the rising prevalence of chronic diseases, particularly cardiovascular and blood disorders. In addition, increased awareness about these conditions enhances diagnostic rates, while government investments in healthcare infrastructure support market growth. Furthermore, the aging population and advancements in medical technologies, such as point-of-care devices, further propel the market. The growing incidence of hemophilia and other blood-related disorders also contributes to this upward trend in the coagulation sector.

Coagulation analyzers are vital medical instruments designed to evaluate blood clotting capability. They are essential for diagnosing bleeding disorders and managing anticoagulant therapies. These devices assess critical parameters such as Prothrombin Time (PT) and Activated Partial Thromboplastin Time (APTT), offering valuable insights into the functionality of the hemostatic system. Their significance is underscored by their role in facilitating prompt diagnoses of conditions such as hemophilia and thrombosis, enabling healthcare providers to develop effective treatment strategies and enhance patient outcomes in clinical environments.

Rising industrial activities and the growing demand for effective water treatment chemicals significantly contribute to coagulation. Coagulants are crucial in stabilizing treatment processes, especially in industries with common operational unpredictability. In addition, the healthcare sector's increasing reliance on coagulants to enhance blood clotting during surgeries and accidents is expected to drive market growth. With over 300 million major surgical procedures yearly, precise coagulation management is paramount. Furthermore, the pulp and paper industry faces stricter regulations regarding wastewater discharge, leading to an uptick in coagulant usage for treating effluent and managing anionic waste. Producing black liquor as a byproduct necessitates efficient treatment methods such as electrocoagulation, which proves effective and cost-efficient.

Product Insights

Consumables led the market and accounted for the largest revenue share of 61.0% in 2024 attributed to the increasing prevalence of blood disorders and cardiovascular diseases, which necessitates regular monitoring and testing, leading to higher demand for consumables such as reagents and test kits. In addition, technological advancements have resulted in developing more efficient and accurate consumables, enhancing their adoption in clinical settings. Furthermore, the rising focus on point-of-care testing further boosts the need for readily available consumables as healthcare providers seek rapid and reliable results.

Furthermore, the consumables segment is categorized into Reagents and Stains. Reagents dominated the consumables segment and accounted for the largest revenue share in 2024, owing to the increasing prevalence of blood disorders and the rising number of surgical procedures that necessitate accurate and efficient coagulation testing, driving demand for high-quality reagents. In addition, advancements in reagent technology enhance testing accuracy and reliability, encouraging their use in clinical settings. Furthermore, the growing emphasis on point-of-care testing further boosts the need for readily available reagents as healthcare providers seek rapid diagnostic solutions to improve patient outcomes.

The analyzer segment is expected to grow at a CAGR of 5.8% over the forecast period owing to the rising incidence of chronic diseases, particularly cardiovascular conditions, which has increased the need for effective coagulation monitoring solutions. In addition, the growing emphasis on early diagnosis and preventive healthcare is pushing healthcare facilities to invest in advanced coagulation analyzers. Furthermore, expanding healthcare infrastructure in emerging markets creates new opportunities for analyzer adoption. As hospitals and laboratories increasingly prioritize patient outcomes, the demand for reliable and sophisticated coagulation analyzers continues to rise.

Technology Insights

Optical technology dominated the market and accounted for the largest revenue share of 61.8% in 2024 attributed to innovations such as fluorescence and photometric detection methods that enable more accurate measurement of coagulation parameters, improving diagnostic capabilities. The integration of optical technologies allows for real-time monitoring and analysis, which is crucial for timely clinical decision-making. Furthermore, as healthcare providers increasingly adopt point-of-care testing solutions, optical methods provide the necessary portability and ease of use, making them ideal for diverse settings. This trend towards advanced optical techniques will continue driving market expansion as demand for efficient and reliable coagulation testing rises.

Electrochemical technology is expected to grow at the fastest CAGR over the forecast period attributed to the increasing prevalence of blood disorders and cardiovascular diseases, necessitating accurate and efficient coagulation monitoring, which electrochemical methods provide. These technologies enable rapid testing with high sensitivity and specificity, making them ideal for point-of-care applications. In addition, electrochemical sensor advancements enhance coagulation test reliability, further promoting their adoption in clinical settings. Furthermore, the growing emphasis on personalized medicine and real-time monitoring also fuels demand for electrochemical solutions, as healthcare providers seek to improve patient outcomes through precise diagnostics.

Test Insights

Prothrombin time (PT) testing led the market and accounted for the largest revenue share of 25.4% in 2024 driven by the increasing prevalence of bleeding disorders and cardiovascular diseases, necessitating regular monitoring of coagulation parameters, with PT testing being a critical component. In addition, technological advancements have improved the accuracy and efficiency of PT testing, making it more accessible in clinical settings. The rising number of surgical procedures also fuels demand for PT tests to assess bleeding risk pre-and post-surgery. Furthermore, heightened awareness among healthcare providers and patients about the importance of coagulation monitoring contributes to the growing adoption of PT testing.

Activated partial thromboplastin time (APTT) testing is expected to grow at a CAGR of 4.7% over the forecast period. The rising incidence of conditions such as hemophilia and other bleeding disorders increases the need for effective monitoring solutions such as APTT tests. Moreover, the growing emphasis on anticoagulant therapy management necessitates routine APTT testing to ensure patient safety and treatment efficacy. Technological advancements have led to more precise and rapid APTT testing methods, enhancing their utility in clinical practice. Furthermore, government initiatives to improve healthcare access and funding for diagnostic tools further support the expansion of APTT testing in the coagulation market, ensuring that healthcare providers can deliver timely and accurate patient care.

End Use Insights

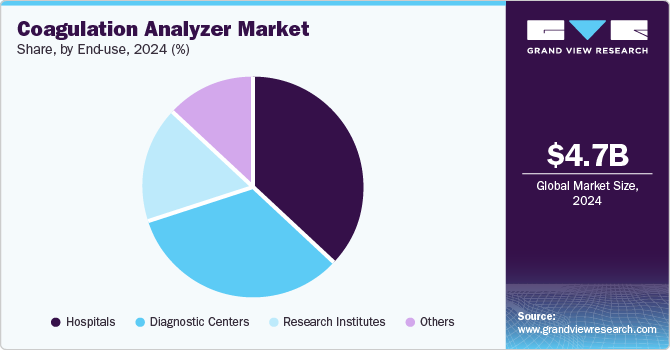

Hospitals led the market and accounted for the largest revenue share of 36.6% in 2024. The rising incidence of chronic blood disorders and cardiovascular diseases drives this growth. As these conditions become more prevalent, hospitals must provide comprehensive coagulation testing and management services. Furthermore, advancements in medical technology have led to the development of more efficient and accurate coagulation analyzers, enhancing diagnostic capabilities. Moreover, government investments in healthcare infrastructure and increased awareness about the importance of coagulation monitoring further drive hospitals to adopt advanced testing solutions, ensuring better patient outcomes and effective treatment plans.

Diagnostic centers are expected to grow substantially, owing to the rising demand for specialized testing services, particularly for coagulation disorders, prompting the establishment of more diagnostic facilities. In addition, as awareness of blood-related conditions increases, patients seek timely and accurate diagnostic services, which diagnostic centers can provide. Moreover, advancements in point-of-care testing technologies enable rapid results, making these centers more appealing to healthcare providers and patients. Furthermore, the growing focus on preventive healthcare and early diagnosis further supports the expansion of diagnostic centers in the coagulation market, as they play a crucial role in managing patient health effectively.

Regional Insights

The North America coagulation analyzer market dominated the global market and accounted for a revenue share of 42.7% in 2024 attributed to the region's advanced healthcare infrastructure and high prevalence of chronic diseases. The increasing incidence of blood disorders, such as hemophilia and thrombosis, necessitates effective coagulation monitoring. In addition, key players' significant investments in research and development enhance the availability of innovative Analyzer. Furthermore, a growing emphasis on preventive healthcare and early diagnosis and government initiatives to improve healthcare access support market expansion in this region.

U.S. Coagulation Analyzer Market Trends

The coagulation Analyzer market in the U.S.is expected to grow significantly, owing to a robust healthcare system characterized by high spending on medical devices and diagnostics. In addition, the rising number of surgical procedures and an aging population contribute to increased demand for coagulation testing. Moreover, regulatory support for new product approvals encourages innovation, enabling healthcare providers to effectively adopt reliable solutions for managing bleeding disorders.

Asia Pacific Coagulation Analyzer Market Trends

The Asia Pacific coagulation Analyzer market is expected to grow at a CAGR of 6.6% over the forecast period owing to a rising geriatric population and increasing prevalence of blood disorders. In addition, economic development in countries such as India and China has led to improved healthcare infrastructure and accessibility. Furthermore, government initiatives aimed at enhancing healthcare services contribute to market growth. The rising number of surgeries and advancements in point-of-care testing technologies further boost demand for coagulation analyzers across the region.

The coagulation Analyzer market in China is expanding significantly due to a surge in chronic diseases and an increasing focus on healthcare modernization. The country's large population and rising disposable incomes drive demand for advanced diagnostic solutions. In addition, government investments in healthcare infrastructure and initiatives to improve disease management contribute to market growth. Furthermore, the prevalence of conditions such as hemophilia emphasizes the need for reliable coagulation testing, positioning China as a key player in the Asia-Pacific market.

Europe Coagulation Analyzer Market Trends

The growth of Europe coagulation Analyzer market is influenced by its well-established healthcare system and increasing investments in medical technology. In addition, the rising incidence of blood-related disorders necessitates effective diagnostics and treatment options. Furthermore, stringent regulatory frameworks ensure high-quality products are available, fostering trust among healthcare providers. Moreover, collaborative efforts between public health organizations and private sectors to improve patient outcomes drive innovation and adoption of advanced coagulation solutions across Europe.

UK Coagulation Analyzer Market Trends

The coagulation Analyzer market in the UK is expected to witness significant growth over the forecast period, driven by heightened awareness of bleeding disorders and advancements in diagnostic technologies. The National Health Service (NHS) prioritizes early diagnosis and management of conditions such as hemophilia, leading to increased demand for coagulation testing. In addition, ongoing research initiatives to improve treatment options contribute to market expansion. Furthermore, the UK’s commitment to enhancing healthcare accessibility ensures that innovative coagulation solutions are effectively integrated into clinical practice, supporting better patient care outcomes.

Key Coagulation Analyzer Company Insights

Some of the key players in the market include F. Hoffmann-La Roche Ltd, Abbott Laboratories, Siemens Healthineers, and others. Companies in the market adopt several strategies, such as technology innovation, automation, and integration of advanced features such as artificial intelligence to enhance diagnostic accuracy and gain a competitive advantage. Strategic partnerships and collaborations with healthcare institutions help expand market reach. Furthermore, companies prioritize cost-effective solutions to cater to diverse healthcare settings, ensuring affordability while maintaining quality.

-

Abbott Laboratories offers various coagulation systems, such as the Sekisui CP3000, fully designed to assess bleeding and clotting functions in the blood. The company operates primarily in the medical devices and diagnostics segment, focusing on innovative technologies that enhance patient care and streamline laboratory processes.

-

Thermo Fisher Scientific provides a high-performance Analyzer that measures critical coagulation parameters, facilitating accurate diagnosis and monitoring of blood disorders. The company operates within the healthcare and life sciences segment, emphasizing automation and efficiency to support clinical laboratories and healthcare providers in delivering reliable diagnostic results.

Key Coagulation Analyzer Companies:

The following are the leading companies in the coagulation analyzer market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd

- Siemens Healthineers

- Abbott Laboratories

- Thermo Fischer Scientific

- Instrumentation Laboratory

- Sysmex Corporation

- International Technidyne Corporation

- Beckman Coulter Inc

- Helena Laboratories

- Meril Life Sciences Pvt. Ltd.

Recent Developments

-

In February 2023, Siemens Healthineers announced a global OEM agreement with Sysmex Corporation focused on hemostasis products. This collaboration allows companies to supply diagnostic products for blood clotting disorders and anticoagulant therapy monitoring under their respective brands. With over 25 years of partnership, the agreement aims to enhance its extensive hemostasis product portfolios, addressing the growing demand for diverse testing solutions. Both companies are committed to improving access to effective hemostasis testing worldwide, ultimately benefiting patient outcomes.

Coagulation Analyzer Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.99 billion |

|

Revenue forecast in 2030 |

USD 6.43 billion |

|

Growth rate |

CAGR of 5.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, test, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, Brazil, Argentina, Saudi Arabia, UAE, Kuwait, South Africa |

|

Key companies profiled |

F. Hoffmann-La Roche Ltd; Siemens Healthineers; Abbott Laboratories; Thermo Fischer Scientific; Instrumentation Laboratory; Sysmex Corporation; International Technidyne Corporation; Beckman Coulter Inc.; Helena Laboratories; Meril Life Sciences Pvt. Ltd. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Coagulation Analyzer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global coagulation Analyzer market report based on product, technology, test, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Analyzer

-

Consumables

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical

-

Electrochemical

-

Optical

-

Others

-

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

APTT

-

D-Dimer

-

Fibrinogen

-

Prothrombin

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Research Institutes

-

Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."